Investment Opportunities

Investment Opportunities

OnchainLabs – The Infrastructure Powering RWA at Scale

Company Snapshot

- Founded: 2024, Crypto Valley (Zug, Switzerland)

- Team: 7 experienced operators (finance, tech, design, compliance)

- Pre-Seed: Successfully closed with family office backing

- Current Round: Raising $2.5M Seed at $10M pre-money valuation

Vision

OnchainLabs is redefining how people connect with value.

We provide white-label, no-code wallet infrastructure that enables enterprises to issue, manage, and distribute tokenized real-world assets (RWA) seamlessly.

Problem

- Liquidity exists in wallets, demand exists in RWA projects — but friction, complexity, and regulation block adoption.

- Current Web3 wallets are crypto-native only, sidelining retail usability.

- Fragmented custody and integration models prevent scale.

Solution

WalletTwo + Engage – a modular, whitelabel wallet command center:

- No-code platform for tokenization

- Web2 interface, Web3 architecture (credit cards, bank withdrawals, no gas fees)

- Built-in engagement tools (loyalty, rewards, events)

- Chain-agnostic, compliant, scalable

Traction

- MVP live with paying clients

- 200k wallet volumes, 1,000+ wallets registered

- Institutional pilots underway

- Revenue projection: $500k by EOY 2025

Market

- Non-financial RWA market projected at $4.8T by 2030 (BCG)

- Institutional adoption accelerating: JPMorgan, Stripe, Meta, Mastercard, Coinbase/AWS

- Usability is the last frontier — OnchainLabs is positioned to lead.

Competitive Edge

Unlike Web3 wallets or tokenization platforms, OnchainLabs offers:

✅ Whitelabel infrastructure

✅ No-code simplicity

✅ Web2 developer focus

✅ RWA-ready architecture

✅ UX-first design (stablecoins, ramps, fiat integration)

Clients & Partners

- CrowdSports, zai, Denario, NF Grapevine, SIXR

- Partnerships with Adesso, Sumsub, Transak, MoonPay, MME Legal

Use of Funds

- Scale infrastructure

- Expand product suite (Smart Wallet v2, AI onboarding)

- Unlock new RWA verticals (commodities, luxury goods, wine & spirits, loyalty)

WalletTwo · OnchainLabs Product

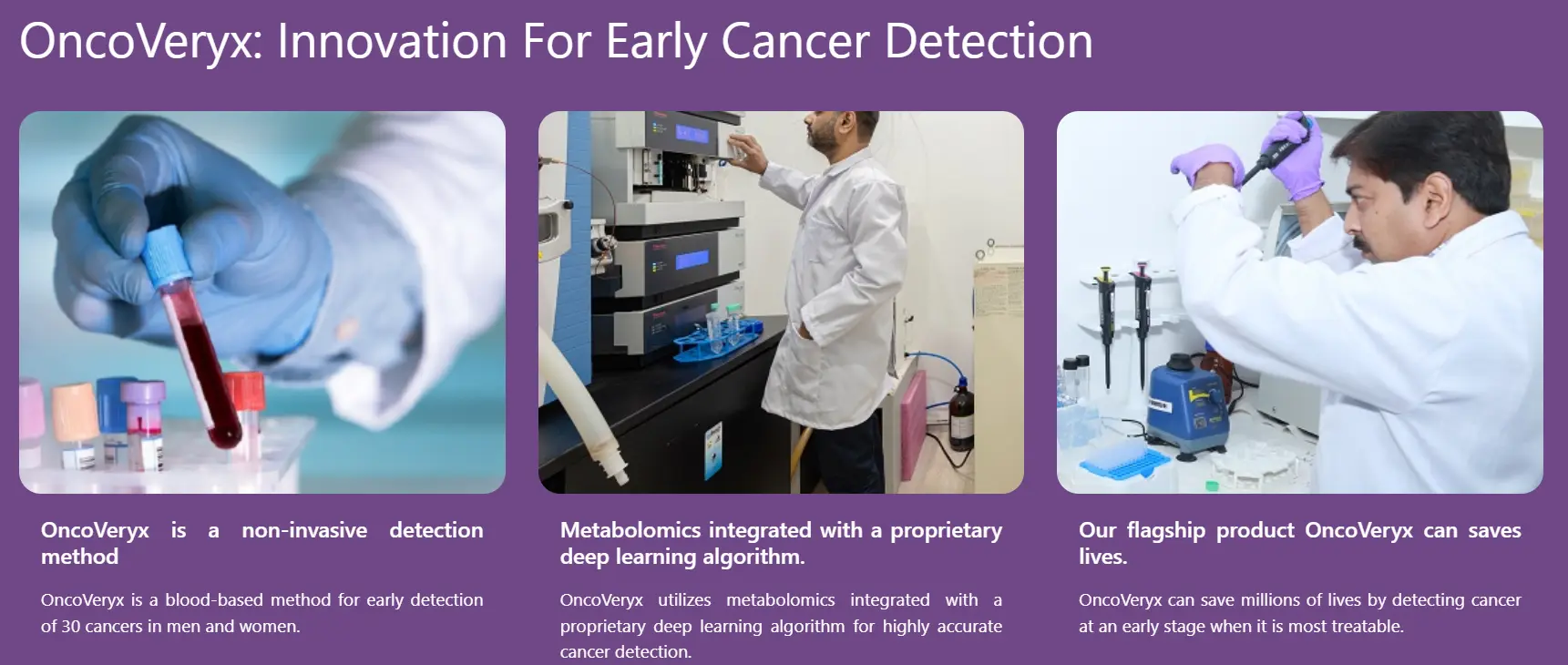

Transforming Cancer Detection with Breakthrough Innovation

PredOmix Health Sciences is a Singapore-headquartered biotech company revolutionizing early cancer detection through its proprietary OncoVeryx platform—a metabolomics-based liquid biopsy test capable of detecting 55 types of cancer from a single blood sample with unmatched accuracy.

The Innovation: OncoVeryx

- World’s First to use Whole Body Physiome Mapping (WPM) for cancer detection

- >98% Sensitivity, >99% Specificity, >98% Accuracy across all stages

- Clinically validated on 10,000+ subjects

- Detects cancer even in asymptomatic patients

- Pinpoints Tissue of Origin (TOO) with high precision

- Requires only 1 ml of blood—non-invasive, cost-effective, and scalable

Market Opportunity

- Global MCED market projected to reach $20B by 2031, growing at 36% CAGR

- Rising cancer incidence and demand for early detection solutions

- PredOmix targets $200M+ revenue over the next 3–4 years by screening 1M+ individuals

- Expansion roadmap: India (2025) → US (2026) → Singapore (2026) → GCC, EU, ANZ

Business Model

- B2B2C approach via:

- Physicians & hospitals

- Corporate wellness programs

- Insurance providers

- Pharma & CRO partnerships

- Applications include:

- Early screening

- MRD monitoring

- Relapse surveillance

- Preventive wellness

Team & IP

- Led by seasoned experts in biotech, AI, and healthcare

- 7 approved copyrights, 5 pending, 1 international patent filed

- CLIA certified, ISO compliant, and FDA pathway initiated

Funding Ask

Seeking $15M Series A to scale operations, accelerate regulatory approvals, and expand market reach.

Use of Funds:

- Clinical studies: $5M

- Capex: $3.5M

- Opex: $3M

- Marketing: $3M

- IP & Patents: $0.5M

Why Invest in PredOmix?

- First-mover advantage in metabolomics-based MCED

- Validated technology with global scalability

- Massive unmet need in early cancer detection

- Positioned to become a global leader in precision oncology

Robot Coffee Barista - Premium coffee at your Neiborhood soon served by robot.

ARB Robotics Barista Project

Automating the Future of Coffee in Singapore

Executive Summary

- Market Size: S$2B+ coffee & tea market in Singapore (2025 est.)

- Daily Footfall Opportunity: 9–10M commuters, mall-goers, and travelers

- Target Capture: 1% = 90,000 daily users

- Revenue Potential: S$70M annually at $2 average spend

The Concept

Born from loyalty program insights, ARB leverages robotics to deliver fast, affordable, and consistent coffee and tea experiences. Positioned between traditional kopi and premium cafés, ARB fills a market gap with mid-priced, high-efficiency offerings.

Innovation Edge

- Fully automated barista units

- Nutri-Grade compliant beverages

- Seasonal & culturally inspired SKUs

- Co-branding with influencers and lifestyle brands

Investment Opportunity

- Per Unit Revenue: $200K–$300K annually

- Annual Cashflow: $25K–$50K per unit

- Buyback Option: 1.5x return by Year 3 (Seed stage)

Roadmap to IPO

- Year 1: Launch 100 units

- Year 2: Expand to 180 units

- Year 3: IPO-ready, targeting $200M+ valuation

Competitive Advantage

Unlike traditional cafés, ARB offers:

- 24/7 scalability

- Data-driven customer engagement

- Lower operational costs

- Faster service with consistent quality

Seeking for S$2.5m for this pre-seed round. Min investment is S$25k/lot up to S$500k. Contact us for more info.

Empowering Real Assets in the Digital Age

Vision

- WTBDC is building a global tokenized finance infrastructure that bridges traditional capital markets with blockchain.

- Mission: Transform real assets (gold, energy, bonds, carbon credits, credit lines) into insured, regulated, and liquid digital instruments.

- Goal: Create a new operating system for global finance — compliant, transparent, and scalable.

Value Proposition

- Multi-Asset Tokenization: Gold, energy, bonds, carbon credits, and credit lines.

- Institutional Connectivity: SWIFT + VisaNet integration for seamless on/off-ramps.

- Trust Layer: Lloyd’s insurance, independent audits, full AML/KYC compliance.

- Liquidity Engine: WTP Swap enables 24/7 collateralized liquidity across asset classes.

- Programmable Finance: Smart contracts, cross-chain support, and automated settlements.

Market Opportunity

- Tokenized assets connect $20 trillion+ of traditional capital to DeFi.

- Stablecoin market (~$280B) provides backbone for on-chain settlements.

- Rising demand for carbon credit tokenization and ESG-compliant investments.

- Institutional adoption accelerating (BlackRock, Franklin Templeton, Fidelity already active in tokenization).

Traction

- Legal structure and governance established.

- Partnerships with UBS, Barclays, HSBC London, Lloyds, Santander, Monzo.

- Completed SWIFT–Blockchain MT199 RWA + MT799 integration.

- Launched pilot contracts for gold (WTP) and energy (ELEC).

- Deployed IBAN + VisaNet prototypes for global settlements.

- Integrated IoT energy data and HSM-secured signing modules.

Roadmap

- Launch bond (BND) and credit (CRX) tokenization.

- Roll out carbon credit program and reconciliation network.

- Expand energy reconciliation rail to intercontinental scale.

- Integrate VisaNet Direct Settlement API for instant payments.

- Achieve MiCA + ISO 20022 + SWIFT CSP certifications.

- Scale global adoption with institutional bank integrations.

Investment Highlights

- Diversified Asset Base: Gold, energy, bonds, carbon, credit.

- Global Infrastructure: SWIFT + VisaNet highways for settlements.

- Institutional-Grade Trust: Insurance, audits, compliance.

- Liquidity & Transparency: 24/7 collateralized swaps, proof-of-reserves, external audits.

- Scalable Growth: Positioned at the intersection of DeFi and TradFi.

Contact us for more info

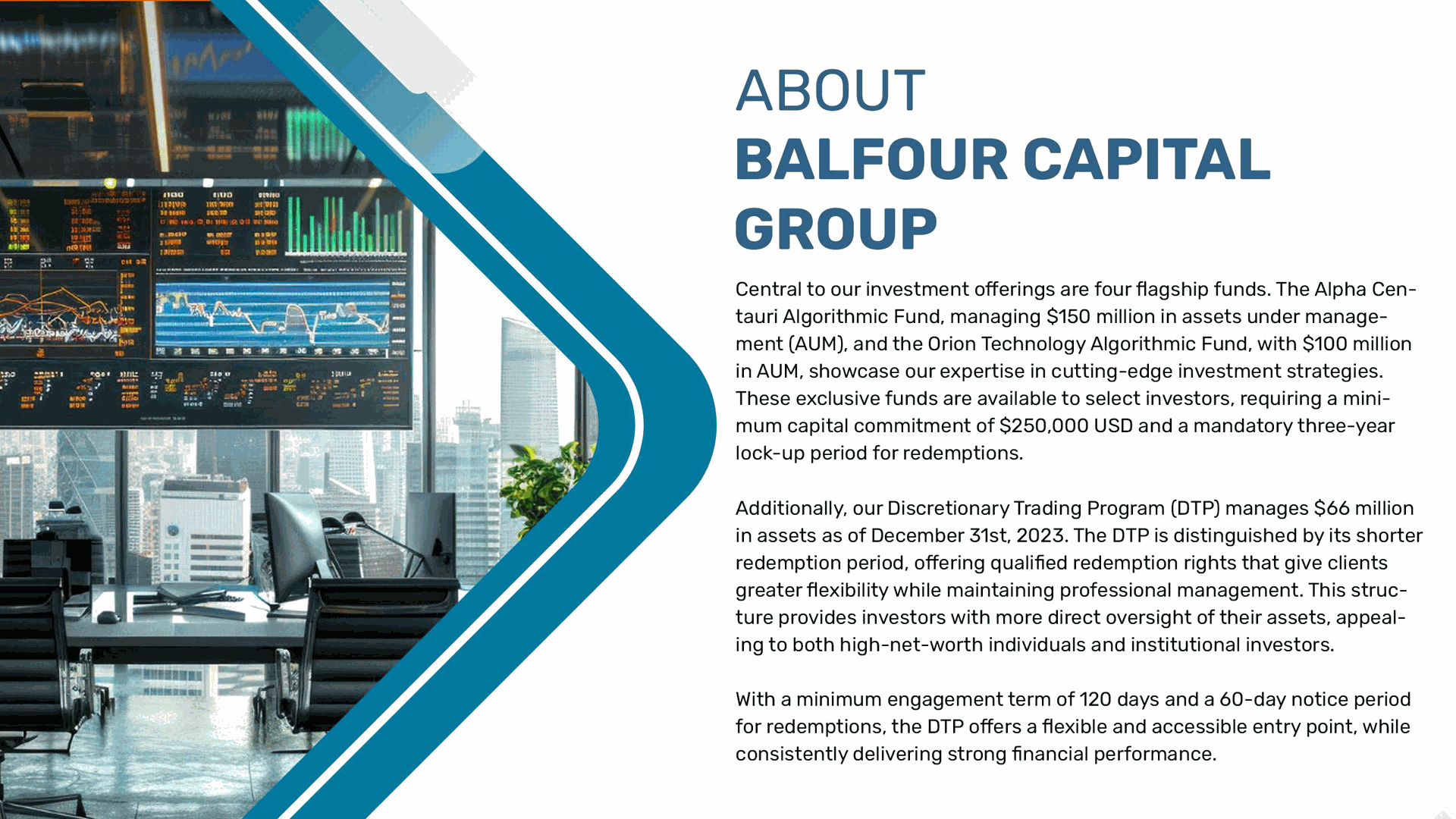

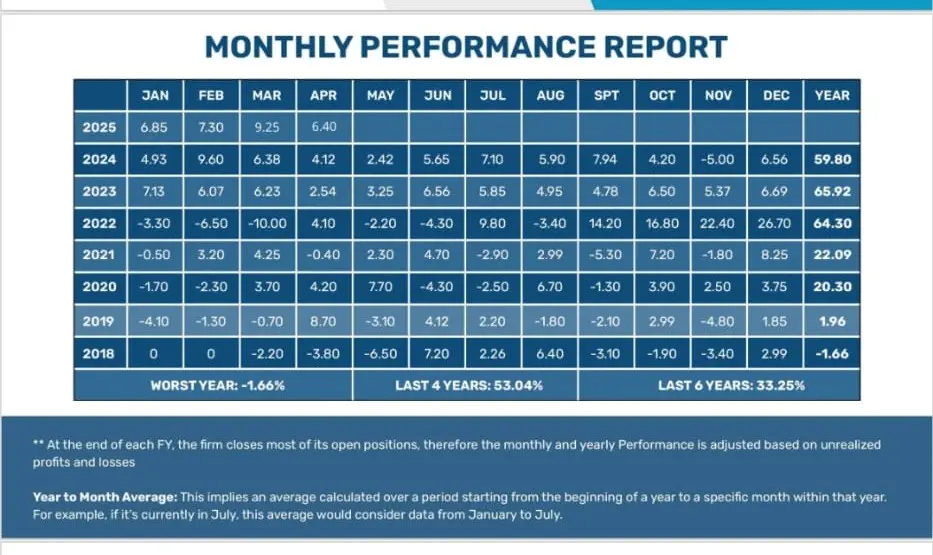

Discretionary Trading Program

Multi assets strategies with own AI Algorithm & Expert trading team

With over 30 years of experience. Balfour Capital Group has firmly established itself as a leader in financial stewardship, delivering tailored solutions to a discerning clientele that includes pension funds, insurance companies, foundations, high-net -worth individuals with a minimum liquid net worth of $250K and prestigious family offices with a net worth exceeding $1 million. Our comprehensive range of services spans real estate and mortgage solutions, life insurance products, and venture capital investments particularly in high-growth sectors such as Technology, Healthcare, and Fintech along with representation of some of the largest developers globally. Impressive compounded ROI of 30-50%pa and proven track records.

Footprint Global Green Energy Asia

At Footprint Global Green Energy Asia, we are committed to pioneering the green mobility revolution across Southeast Asia. Our mission is to promote sustainable transportation solutions through our strategic network of country headquarters and specialized business units

Electrifying Southeast Asia’s Future

Green Gold Asia (GGA) is building the region’s first mall-based EV ecosystem, transforming urban mobility while revitalizing retail hubs across ASEAN.

Opportunity at a Glance

- Proven Model: 5 Jakarta malls secured with SGD 1.25M pilot funding

- Scalable Vision: 300 malls across 11 ASEAN countries by 2028

- Robust Assets: Each mall hosts 15 EV cars, 45 e-bikes, 6 charging stations

- Attractive Returns: 13–15% IRR, 24–30 month payback, DSCR ≥ 1.25x

- Market Tailwinds

- $250B ASEAN EV market projected by 2030

- $320B renewables investment driving infrastructure growth

- $10B carbon credit potential as an additional revenue stream

- Why GGA Wins

- Multi-Product Ecosystem: EV bikes, charging, parts & services, EV vans

- Capital-Efficient Model: Mall partnerships slash capex, boost foot traffic

- Secured Supply Chain: Exclusive OEM partnerships (Sunra, Zytec, Enine, Kinma)

- Digital-First Operations: Odoo ERP + mobile app for seamless customer experience

- Pilot Financials (5 Malls)

- $1.96M annual revenue | $785K gross profit (40% margin)

- Asset-backed security: ≥65% of capital in tangible EV inventory

- Flexible structure: Convertible option for equity upside

- Impact & ESG

- 110,000+ tonnes CO₂ cut annually at scale

- 1,000+ green jobs created across ASEAN

- Direct alignment with UN SDGs 7, 9, 11, 13

- Scaling Roadmap

- 2025: Pilot (5 malls, Jakarta)

- 2026: Regional launch (50 malls, SG/MY/TH)

- 2027: Market leadership (150 malls, VN/PH)

- 2028: ASEAN dominance (300 malls, 11 countries)

Contact us for more info

Stablecoin Payments for the Mass Market

Company Snapshot

- Founded by: Nilesh Lalwani (serial fintech entrepreneur, ex-CASH+)

- Team: Experienced operators across tech, marketing, BD, and ops

- Backed by: TON Ventures, Stellar, Blockchain Founders Group

- Funding Status: Raising $1M Private Round at $10M valuation

- Token Supply: 1B $BION (SAFT/SAFE with warrant)

Vision

Bion is building the consumer rails for stablecoin payments – enabling everyday purchases across fashion, travel, food, and entertainment. From vouchers to cards to QR payments, Bion makes crypto spendable like fiat with cashback and rewards.

Problem

- Stablecoins are liquid but lack consumer payment rails.

- Existing wallets are crypto-native, not retail-friendly.

- Merchants struggle with integration and adoption.

Solution

Bion Ecosystem – Multi-rail stablecoin payments:

- Voucher/Gift Cards (live): Pay with stables, earn cashback

- Card Payments (coming soon): Spend stables anywhere, like fiat

- QR Payments (coming soon): Online/offline instant stablecoin payments

- bionBiz SDK/API: White-label toolkit for businesses to build payment & credit apps

Traction

- 200K+ registered users

- 30K MAU, 6K+ transactions

- 50+ countries, 3K+ brands integrated (Amazon, Netflix, McDonald’s, Emirates, ZARA, Gucci, Walmart, Booking.com, Starbucks, Hilton, Nike, Lenovo, Microsoft, Samsung, IKEA, Expedia, Lufthansa, British Airways, Pizza Hut, Adidas, Sony, Dell, HP, Puma, H&M, Marriott, KFC, Costco, etc.)

- Mini App live in Telegram ecosystem

Revenue Model

- Merchants/Brands: Shopping commissions, voucher fees, priority listing

- Partners: Ads, traffic monetization, payment integration fees

- Users: Transaction fees, subscription fees

Market

- Stablecoin adoption is accelerating globally

- Bion bridges crypto liquidity with consumer usability

- Positioned to scale from product → protocol, enabling multichain ecosystems (TON, Stellar, Binance Smart Chain, Base, Solana, Sui)

Roadmap

- 2025 Q2/Q3: $BION token launch, bionCard, bionCredit, browser extension, AI chatbot, 5,000+ brands onboarded

- 2026: Full ecosystem expansion, developer integrations, DeFi modules

Tokenomics

- Private Round Price: $0.01

- Raise Target: $1M

- Distribution: Community 25%, Team 15%, Ecosystem Reserve 20%, Private 10%, Seed 5%, Advisors 3%, Liquidity 5%, Public 3%, Marketing 10%, KOL 2%, Angels 2%

Contact us for more info

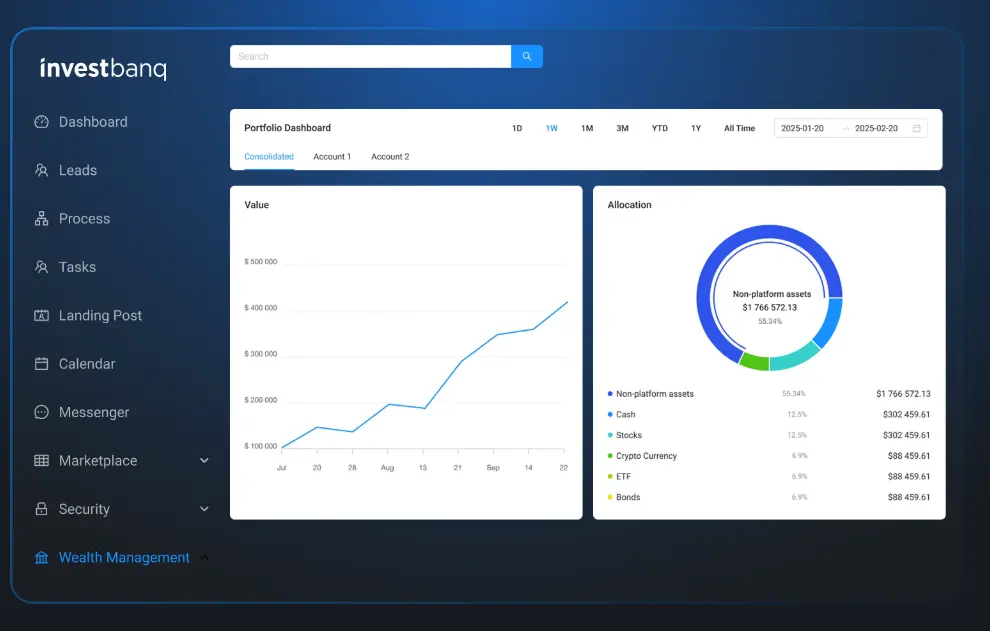

AI-powered Wealth Management Platform for Asset Managers Banks Family Offices HNWI

Investbanq is an AI-enhanced digital investment platform that provides users with unified access to an extensive range of asset classes, including stocks, bonds, private funds, infrastructure, venture investments, and has future plans to incorporate digital assets. Often referred to internally as a ‘ digital private bank,’ the platform is poised to rival traditional private banks and other financial institutions, focusing primarily on the underserved Mass Affluent and HNW individual segments. Target markets include Emerging Asia and the MENA region.

Investbanq has been awarded Best WealthTech Solution – Artificial Intelligence by Global Private Banker!

Raising US$5m Pre-Series A round, with an U$18M pre-money valuation

RWAY specializes in providing tailored software for

businesses looking to tokenize and distribute their assets,

particularly those interested in Real-World Assets (RWA)

We offer a complete software solution that enables companies to build their own infrastructure for asset tokenization & distribution, with optional access to the source code.

This eliminates the need to build from scratch or rely on third party tokenization platforms to list assets on their marketplace.

Problem We are Solving

The current process of tokenizing real-world assets (RWA) is complex, time-consuming, and costly for businesses. Companies face significant challenges in building blockchain infrastructure, ensuring regulatory compliance, and creating user-friendly, secure platforms for token management and investing options.

Developing these solutions from scratch also delays time-to-market and adds operational burdens, especially for businesses new to the space.

Seeking US$1m to scale up

To help mankind live healthier, happier, and purposeful lives

A Malaysia-based nutraceutical company develops and markets a distinctive line of superior quality and high-efficacy products for the global marketplace. We continually search, identify and evaluate high value ingredients that work in synergy; backed by science, supported with documentation and the regulatory compliance our customers demand to target specific health needs.

Our products offer research validated bio-active product solutions that are of the highest potency and which will greatly impact their respective health categories. The company’s visionary research and passion for helping people to live healthier and joyful lives is the driving force for our team.

Spreading our wings to six neighboring countries namely Singapore, Indonesia, Thailand, Cambodia, Vietnam and China, Everro is out.

Seeking US$5m for expansion and IPO in Nasdaq.

Silver Spring Club

Affordable Paradise for Active Retirees in Thailand

Overview

Silver Spring Club is a membership-based retirement village concept spanning three prime locations in Thailand—Chiang Mai, Chiang Rai, and Chachoengsao. Designed for active seniors aged 50+, the Club offers a vibrant lifestyle, wellness-focused amenities, and cultural immersion at an accessible price point.

Investment Highlights

- Scalable Model: Asset-light membership structure enables oversubscription and geographic expansion (e.g., Japan, EU).

- EBITDA Margin: Projected at a robust 63%, driven by pay-per-use services and high-margin memberships.

- Recurring Revenue: Long-term memberships (1–20 years) with renewal income and optional excursions.

- Exit Strategy: REIT conversion potential post-stabilization.

- Appeal to Foreigners: No land ownership hurdles; transferable memberships with concierge support.

Locations & Lifestyle

- Chiang Mai: Mountain living, nature trails, elephant adventures.

- Chiang Rai: Onsen wellness, Golden Triangle tours.

- Chachoengsao: Marina Yacht Club, island hopping, beach activities.

Each site offers 150 units (apartments & villas), universal design for senior safety, and proximity to hospitals (10–15 mins).

Development Timeline

- 2025: Launch all 3 locations

- 2026: Partial opening

- 2028: Full completion (450 units total)

Financial Snapshot

- Total Membership Revenue: USD 55.2M (720 members)

- Construction Budget: THB 1.05B (~USD 28M)

- Bank Loan Facility: THB 3.8B with 80/20 drawdown structure

- Discount Rate: 8%

Target Markets

- Seniors from Singapore, Hong Kong, Australia, Europe, and China

- Strategic tie-ups with airlines, insurers, private banks, and property agents

Call to Action

Seeking Joint Venture Partners and strategic investors to co-develop and scale the Silver Spring Club across Asia. Be part of a high-growth, socially impactful venture redefining retirement living.

?

Contact us for more info